Business Insurance in and around Louisville

One of the top small business insurance companies in Louisville, and beyond.

Insure your business, intentionally

Business Insurance At A Great Value!

It takes courage to start your own business, and it also takes courage to admit when you might need help. State Farm is here to help with your business insurance needs. With options like worker's compensation for your employees, extra liability coverage and business continuity plans, you can rest assured that your small business is properly protected.

One of the top small business insurance companies in Louisville, and beyond.

Insure your business, intentionally

Small Business Insurance You Can Count On

Whether you own a tailoring service, an arts and crafts store or a farm supply store, State Farm is here to help. Aside from fantastic service all around, you can personalize a policy to fit your business's specific needs. It's no wonder other business owners choose State Farm for their business insurance.

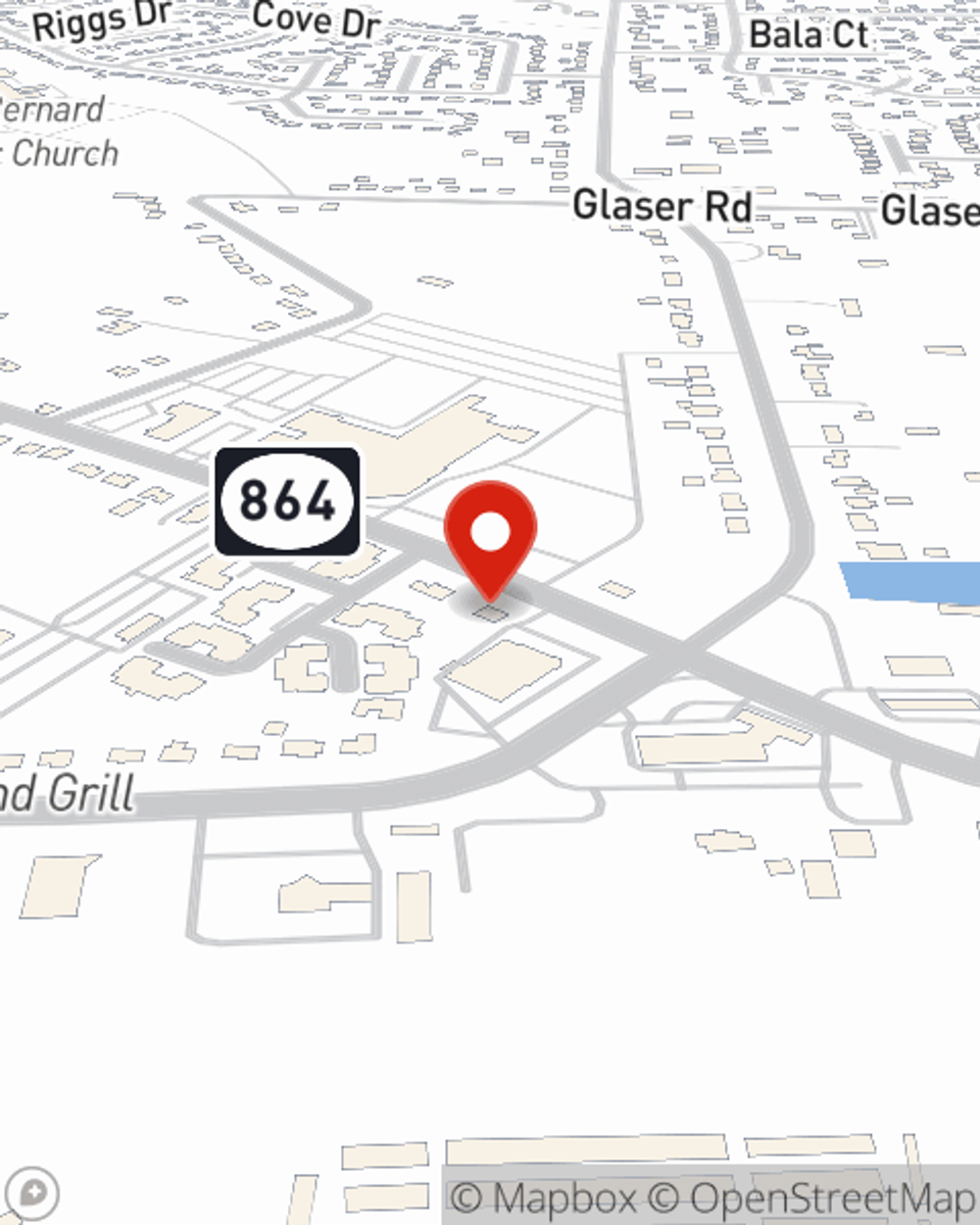

Get right down to business by visiting agent Jaime Sicairos's team to explore your options.

Simple Insights®

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.

Jaime Sicairos

State Farm® Insurance AgentSimple Insights®

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.